In this article I will talk about my personal strategy for long-term portfolio building, you should consult with a professional or do your own research before copying what I do for my own investments.

The first step I take is to take a macro-level look at the market and politics.

This gives me a sense of the general sentiment.

Humans are the reason for market fluctuations, so naturally I want to know where we are going collectively and whether I agree or not, politically, majority rules. This is a long-term portfolio, so I want it to be somewhat on the least volatile end.

In this example I will build a portfolio with stocks I do not own.

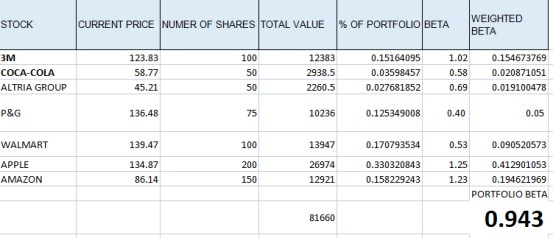

What I did here is choose the stocks that I liked after some research, from news and other financial numbers I looked at such as Beta. I prefer low Beta for this portfolio, since it will be long-term semi-slow growth strategy.

The amount of each depends on my personal preferences and beliefs about the future of these companies.

Beta measures the expected move in a stock, relative to movements in the overall market.

Beta of 1.0 means the stock mirrors the volatility

Beta of anything above 1.0 means the stock is more volatile than the overall market

Beta below 1.0 means the stock has lower volatility than that of the overall market.

As you can see my portfolio is right under 1.0, at 0.94, that means my portfolio’s volatility is very much in line with the S&P 500.